Cap Rate Calculator

If you're thinking of adding real estate investments to your portfolio, you can benefit from using a cap rate calculator. A property's cap rate is the rate of return based on the amount of income you receive. With our cap rate calculator, you can perform this measurement in seconds. It can help you determine if the property's sale price is justified.

What Is Cap Rate?

The cap rate (capitalization rate) is the rate of return on an investment property based on its net operating income. The basic formula for cap rate is to divide a property’s net operating income (NOI) by the property value. This measurement tells you how much of your initial investment will be returned to you each year.

Let's say you buy a turnkey property for $200,000 and have a cap rate of 10%. This means your NOI on the property would be $20,000 per year.

How to Calculate Cap Rate with the Rental Calculator

Before you purchase a rental property, you need to do multiple calculations to make sure you invest your money wisely. A property's cap rate is based on factors like ongoing expenses and market value. Our Rental Calculator considers these factors to provide you with a percentage that you can compare to other properties you're thinking of buying.

Rent to Retirement's Rental Calculator is able to calculate MUCH more than the cap rate! Check out our rental property calculator guide!

Step 1. Fill in Purchase and Property Value Data

First, fill in the purchase price and property value data. If the property is listed for $400,000, place this number in the calculator.

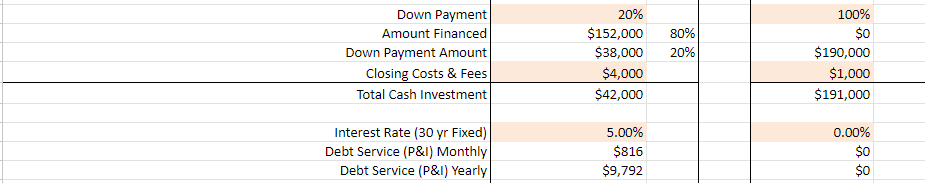

Step 2. Fill in your Financing Information

The next step in this process involves filling in your financing information, which includes your down payment, the loan amount, and the interest rate.

Step 3. Enter Rent and Expense Information

Now it's time to enter the rent you'll collect and the expenses you'll pay. Your annual expenses can include costs like maintenance, property taxes, property management, utilities, and insurance premiums. If you can collect $1,4000 in monthly rent, write down this amount in the applicable space.

.png?width=843&height=175&name=unnamed%20(1).png)

Step 4. View Cap Rate!

To find your cap rate, look for "Cash-On-Cash ROI from rent income only-yr. 1", which is found under the "Cash" column. This is your cap rate, which is displayed as a percentage.

.png?width=922&height=193&name=unnamed%20(2).png)

Cap Rate Formula

The cap rate formula is Cap Rate = NOI / Property Value. Performing this calculation is an easy way to screen whether a property is worth buying. However, it's NOT the sole metric you can use when deciding whether to buy a property. You can also include other calculations like cash-on-cash return, return on investment, cash flow, and more.

When making this calculation, don't include mortgage payments. These payments aren't viewed as operating expenses. The same is true of income taxes and depreciation. Your net income is the total cash you earn before income tax and debt service.

What Is NOI (Net Operating Income)?

Net operating income refers to the property's profit after you've subtracted all your expenses from the revenue. Since mortgage payments aren't part of NOI calculations, this measurement can be helpful if you purchase a property with cash. To perform the NOI calculation, you must first add up all your expenses. The many expenses you can pay as a rental property owner include the following:

- Pest control

- Maintenance

- Tenant screening

- Marketing

- Property taxes

- Inspection or broker fees

- Property management

- Home insurance

You'll also be tasked with adding all your revenue sources together before you subtract your expenses. Use this number to identify the property's cap rate. If you perform this calculation before buying a property, the data that you feed into it will be based on estimates of your future expenses.

Cap Rate Example

Let's say that you're buying a property that costs $500,000 and provides you with a net operating income of around $60,000 every year. When you use the basic cap rate formula, all you need to do is divide $60,000 by $500,000. The answer is 0.12, which means that the property has a 12% cap rate.

Looking for high-return rental properties?

Why Is Cap Rate Important?

Cap rate isn't the be-all and end-all of real estate formulas, but it's an extremely useful one that lets you compare the profit potential of multiple properties at once. You can use these calculations to make several different comparisons. For example, the cap rate calculation allows you to compare the value of the rental property to the neighboring ones.

In most cases, properties within proximity of the one you're interested in should have similar cap rates. This comparison can help you determine if a property is priced too low or too high. If the cap rate of your property differs substantially from the rest, there might be underlying issues that are affecting the cap rate.

You can also use cap rate to find appealing properties that have gone unnoticed among other investors. If you discover a property that has a cap rate that's much higher than other places in the vicinity, this might indicate that it has been mismanaged. In this scenario, you could obtain a high return on investment if you reduce annual expenses and streamline property management.

The Downside of Using Cap Rate

While a property's cap rate can tell you a lot about an investment and how it might perform, there are some downsides to solely relying on this metric. It allows you to make quick calculations and comparisons between multiple properties, but it doesn't consider your mortgage.

Let's say that you locate a property with a relatively high cap rate. In this situation, the purchase price may be affordable. However, it can be challenging to find lending companies that are willing to provide loans for high-risk properties.

You may need to settle for a loan that comes with a higher interest rate. A monthly mortgage payment with a high interest rate could erase your return, which is why you should consider other metrics like return on investment (ROI), cash flow, and cash-on-cash return (CoC). All these metrics take your mortgage into account.

There are a few other limitations you should consider as well. Capitalization rate calculators aren't useful unless you perform comparisons. If you're buying a property in a smaller or more unique market, it can be challenging to find comparable properties. When using this calculation, you'll also need to gather historical data regarding property costs, which can be difficult to source.

What Influences Cap Rate?

Several factors influence the cap rate, which include everything from your rental income to the monthly expenses you need to pay. Consider these factors to arrive at an accurate calculation.

1. Income

If your rental income goes up, the property's cap rate will also rise. Properties that can earn higher income may also come with more risk.

2. Expenses

When expenses go up, the cap rate goes down. In this scenario, it will take longer for you to recover your initial investment. If you purchase a dilapidated property that requires ample repairs, your expenses may be high and your cap rate may be low until you make the necessary fixes.

3. Property Value

If the property value goes up, the cap rate goes down. More valuable properties have lower cap rates and usually come with less risk.

Analyze Real Estate Like a Pro

Cap rates often hover between 5%-10%, which is a healthy range depending on the amount of risk that's acceptable for your portfolio. If the cap rate is too low or too high, there may be something wrong with the property.

Compare the cap rate to similar properties in your area to gain a better understanding of what the rate should be. While high cap rates are riskier, you may be able to earn more income. Want expert investing help BEFORE you buy your first or next investment property? Sign up for the Rent to Retirement Academy!

Cap Rate Calculator FAQs

How Do You Calculate the Cap Rate?

You can use a simple formula to calculate the cap rate, which is as follows: Cap Rate = NOI / Property Value. You don't need to perform an appraisal to find the property value. Use the current sale/list price when making this calculation.

Estimate how much rent you'll charge for each tenant. You can input this info into the calculator by month or by year. Once you determine your income, you'll need to calculate your operating expenses to identify the property's NOI. You can then divide the NOI by the property value to find the cap rate. Or, do it all in a couple minutes with our rental property calculator.

What Does a 7.5 Cap Rate Mean?

A 7.5% cap rate doesn't tell you much about the property. It does, however, inform you of the ratio between the property's market value and net operating income. You can use this percentage to determine how risky the investment will be before you go through with it. A 7.5% cap rate is on the high side. However, it may help you recover your initial investment at a quicker rate.

What Is a Good Cap Rate?

A good cap rate can be anywhere from 5%-10%. However, the answer to this question depends on your situation. If you're comfortable with riskier investments, consider properties with 8%-10% cap rates. More cautious investors should look for properties with 4%-6% cap rates to minimize risk.

Is a Higher Cap Rate Better?

A higher cap rate isn't automatically better. While it tells you that you can get your money back faster, you might find it more challenging to maintain the property and attract new tenants.

Understanding the intricate process of acquiring investment properties and armed with a comprehensive strategy, aspiring real estate investors can move forward confidently and knowledgeably as they venture into the real estate market in 2024 and beyond. For more detailed guidance on real estate investment, visit with Rent to Retirement today.

Let's Talk

Terms and Conditions

All information presented comes from third party individuals and the investor community. RTR is simply a real estate education platform available to the general public for anyone who would like to learn more about real estate related topics. Individual owners have the ability to show their properties publicly on our site to find potential deal partners. All information shown comes directly from the individual owner. Each person is encouraged to conduct their own independent verification of any information shown as RTR will not be held responsible for inaccurate information presented by website users. RTR does not act as a buyer, seller or representative of either party in the transaction. You are encouraged to consult with the appropriate professionals you deem necessary to make an informed investment decision.