Rental Property Calculator

When investing in real estate, you can't say with certainty how much income you'll make from the property. You can, however, obtain accurate estimates of everything from cash flow to ROI by using a rental property calculator. In this guide, you'll learn about Rent to Retirement's Proforma Calculator and how to use it for your next real estate investment.

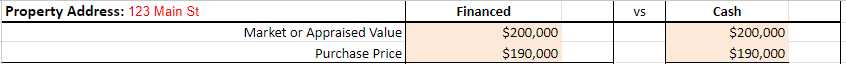

Step 1. Enter Purchase Price and Appraised Value

The first step of using a rental income calculator is to enter the property's purchase price and appraised value, which should be readily available to you. The appraised value is needed to properly estimate appreciation.

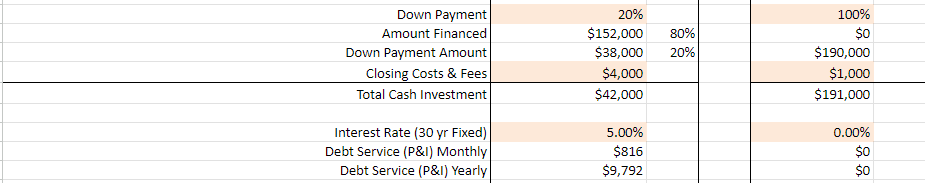

Step 2. Enter Financing Numbers

Before you can estimate your ROI and cash flow with this investment property calculator, you'll need to enter financing numbers, which include your down payment, interest rate, and closing costs. Keep in mind that closing costs are typically around 2% of the purchase price.

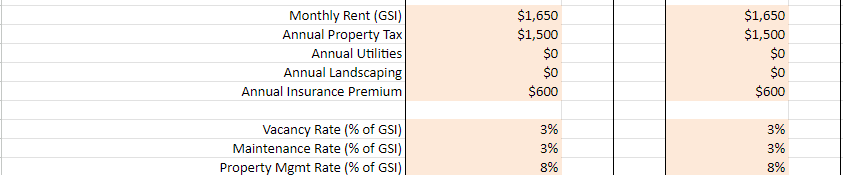

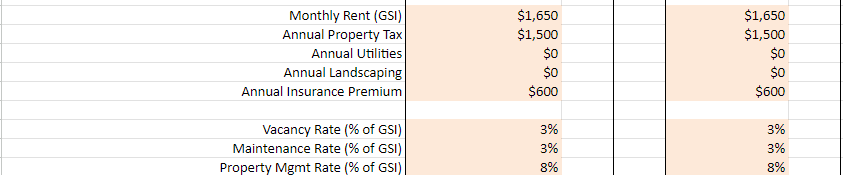

Step 3. Enter Rent, Taxes, Insurance, and Variable Expenses

Once you've filled in the financing info, enter details about all potential expenses with your rental property. The main expenses you'll need to account for include your monthly rent, landscaping, insurance premiums, utilities, annual property tax, vacancy rate, property management rate, and maintenance rate.

Where to Find This Information?

These property details aren’t difficult to find, and having them on hand will give you much more accurate calculations.

- Rent estimates: Rentometer or BiggerPockets Rent Estimator

- Property taxes: You can see the property’s current taxes by looking up your country’s tax assessor website. Note: These taxes may increase upon purchase.

- Utilities: Contact the local utility companies in your area to request an average cost per month based on the home’s size.

- Insurance: Contact a local insurance agent; they will be able to give you actual quotes on the property.

- Vacancy rate: An 8% vacancy rate is standard, which accounts for one month of vacancy per year.

- Maintenance rate: Newer rentals or turnkey rentals tend to have much lower maintenance rates, usually around 5% per month. Older properties can be anywhere from 5% to 15%, so shoot for a higher number to be cautious.

- Property management rate: Most property management companies will charge 8%-10% of rent per month, depending on property type, size, and location.

Step 4. Decide on the Deal

You now have the numbers you need to decide whether or not this is a property worth buying. Wondering what these metrics mean? Scroll down!

Rental Property Metrics Explained

At first glance, the results from your calculations might be difficult to understand. The following describes the most common rental property metrics you'll encounter when investing in real estate.

Appreciation

Appreciation in real estate refers to the amount a property increases in value over time. Property values can increase because of development in the area, a stronger job market, and inflation. You can also take steps to boost your property's value by making targeted home improvements, which include kitchen and bathroom renovations as well as appliance upgrades.

Cash-on-Cash Return

Cash-on-cash return is a measurement that calculates the amount of income earned from the cash you've invested in a specific property. This measurement is necessary when making ROI calculations.

- Formula: Annual Net Cash Flow / Investment Amount = Cash-on-Cash Return

- Example: $5,000 cash flow / $20,000 down payment= 25% CoC Return

Cash Flow

Cash flow is among the most important terms that real estate investors must know. It describes the total amount of money that a rental property produces. You can estimate the cash flow of a potential property by adding up the amount of rent you'll collect and subtracting expenses from it. If you obtain $2,000 in monthly rent and spend $1,500, your cash flow will be $500. Every real estate investor should strive for a positive cash flow.

- Formula: Rent - Expenses = Cash Flow

- Example: $1,200 rent - $600 mortgage - $100 utilities - $120 property management = $380/month cash flow

Depreciation

Rental property depreciation is a tax strategy that allows you to effectively deduct the total cost of your property over an extended period. This deduction can be applied to your taxes every year that depreciation is available, which is typically 27.5 years.

ROI (Return on Investment)

Return on investment (ROI) is a commonly used metric that allows investors to determine if they should purchase a rental property. This calculation allows you to predict your property's profit margin.

- Formula: Profit/Cost of Investment = ROI

- Example: $15,000 yearly cash flow/$150,000 home = 10% ROI

What Is a "Good" ROI for a Rental Property?

When calculating a rental property's potential ROI, “Good” differs based on who you ask. Some people might say a “good” ROI is anything that beats the stock market or their bank’s interest, but many real estate investors say a good ROI is between 8% and 12%. Anything above 5% is decent. The factors that determine what ROI you should aim for include everything from the location to the type of property you've invested in.

Looking for High-ROI Turnkey Rental Properties?

Common Rental Property Expenses

Before you're able to estimate how much money you can make from a single rental property, you must first determine which expenses you'll be tasked with paying every month. From property taxes to repair bills, these costs can add up.

PITI (Principal, Interest, Taxes, Insurance)

PITI represents the costs that make up your monthly mortgage payment. Along with the principal loan amount, you'll also be required to pay interest over the life of the loan. Property taxes and insurance payments are added to these payments as well.

Utilities

Landlords rarely pay ALL of the utilities; some pay none! The utilities you may need to pay for include sewage, trash, internet, water, and electricity.

Property Management

Unless you want to spend a considerable amount of time and money managing the property on your own, it's a good idea to request these services. Property managers often charge around 8%-12% of the rental income that's collected every month. Keep in mind that rental property managers take care of everything from rent collection to repairs.

Repairs and Maintenance

While maintenance and repair costs are often fully deductible for rental properties, you'll need to pay for them before doing your taxes. Repair and maintenance costs include seasonal HVAC inspections, pest control, landscaping, fixing leaks, painting, and replacing air filters.

CapEx (Capital Expenditures)

Capital expenditures (CapEx) are the costs associated with buying, upgrading, or replacing major appliances and systems in a rental property. Since the homes are newly renovated, repairs and CapEx expenditures aren't usually expensive for turnkey real estate investors.

Common Rental Property Calculator Rules of Thumb

Before finalizing your calculations, there are some basic rules of thumb you should consider. Use the 1% and 50% rules to determine if an investment is worth it.

The 1% Rule

In real estate investing, the 1% rule measures an investment property's price against the income it's able to generate. The rent you collect each month needs to match or exceed 1% of the property's purchase price for it to be worthwhile. Let's say that you're interested in a rental that's worth $250,000. You need to collect $2,500 every month to match the 1% rule. Perform this calculation before you buy the property.

The 50% Rule

You can also determine if you should make a real estate investment by adhering to the 50% rule. This rule states that half of the income your property generates needs to go to operating expenses. The purpose of this rule is to help you avoid overestimating your profits and underestimating your costs.

If you expect your property to generate $50,000 in total rent per year, you'll likely spend around $25,000 to cover your expenses. Keep in mind that this rule doesn't include expenses like mortgage payments or HOA dues.

Calculate BEFORE You Buy

Use Rent to Retirement's Proforma calculator to estimate cash flow, ROI, and appreciation. Make sure you use this calculator before buying a rental property. The results can help you decide if an investment is worth it before you even make an offer. If you have any questions about the calculator and how to use it, we're happy to help!

Rental Property Calculator FAQs

What Is a Good ROI on Rental Property?

A good ROI for rental properties is around 8%-12%. As long as the ROI is higher than 5%, you can generate a decent amount of income. Keep in mind that a higher ROI might come with more risks.

What Is the 50% Rule in Rental Property?

When it comes to rental properties, the 50% rule is designed to help investors estimate profitability. By subtracting 50% of the rental income when calculating profits, you'll have a good idea of the minimum profits the property can generate. Investors have a habit of overestimating their profits, which can make mediocre properties appealing. Use this rule to make quick and informed decisions.

What Is Cash-on-Cash Return?

Cash-on-cash return is a measurement that effectively calculates an investment's potential ROI. It weighs your annual property income against the amount of money you've invested in the rental. If you can generate a high cash-on-cash return, you can use the money to pay for additional investments or make a future down payment.

Let's Talk

Terms and Conditions

All information presented comes from third party individuals and the investor community. RTR is simply a real estate education platform available to the general public for anyone who would like to learn more about real estate related topics. Individual owners have the ability to show their properties publicly on our site to find potential deal partners. All information shown comes directly from the individual owner. Each person is encouraged to conduct their own independent verification of any information shown as RTR will not be held responsible for inaccurate information presented by website users. RTR does not act as a buyer, seller or representative of either party in the transaction. You are encouraged to consult with the appropriate professionals you deem necessary to make an informed investment decision.